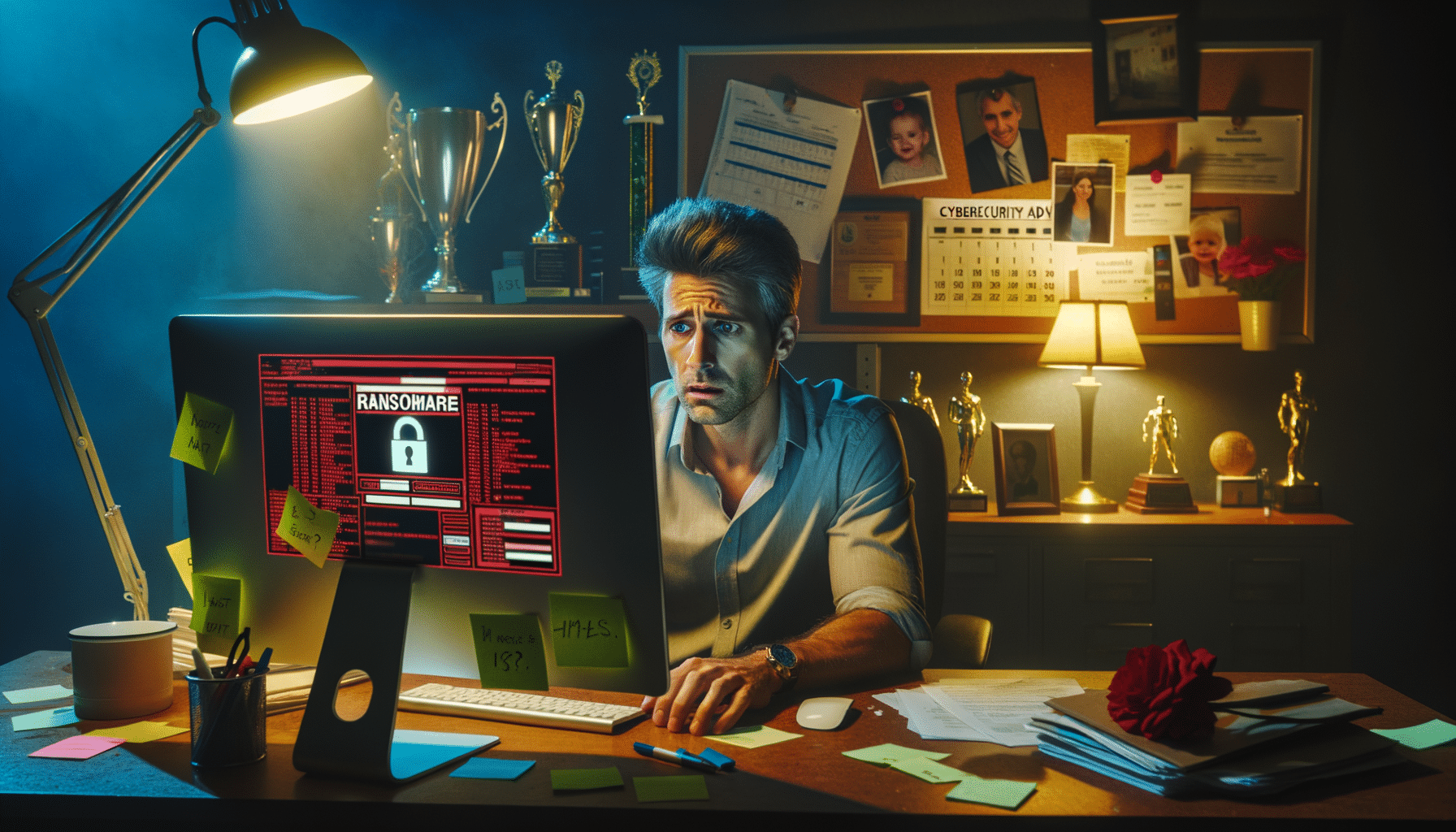

Your small business just lost three days of operations because ransomware locked your customer database. The attack cost you $50,000 in lost revenue, recovery expenses, and legal fees. Here’s the kicker: your general liability insurance won’t cover a penny of it. This scenario happens to thousands of small businesses every year, yet most owners still think cyber threats only target big corporations. Cyber insurance for small businesses isn’t optional anymore—it’s essential survival gear in today’s digital landscape.

Key Takeaways

- Small businesses face the same cyber threats as large corporations but with fewer resources to recover from attacks

- Standard business insurance policies exclude cyber-related losses, leaving massive coverage gaps

- Cyber insurance covers both first-party costs (your direct losses) and third-party liability (customer lawsuits)

- Most small business cyber policies cost between $500-$5,000 annually depending on industry and coverage limits

- Insurance carriers require basic security measures before issuing policies—these requirements actually strengthen your defenses

Why Small Businesses Need Cyber Insurance More Than Ever

I’ve worked with hundreds of small business owners over the past decade. Most assume they’re too small to attract cybercriminals. They’re dead wrong.

Small businesses are actually prime targets for cyber attacks. You have valuable data but weaker security than enterprise companies. You’re the low-hanging fruit.

Consider these statistics from recent FBI reports:

– 43% of cyber attacks target small businesses

– The average cost of a data breach for small companies exceeds $200,000

– 60% of small businesses close within six months of a major cyber incident

Your regular business insurance won’t help. General liability, property, and workers’ compensation policies specifically exclude cyber-related losses. That leaves you exposed to massive financial risks.

The Real Costs of Cyber Incidents

When I talk to business owners about cyber risks, they usually think about ransomware payments. That’s just the tip of the iceberg.

Real cyber incident costs include:

- Business interruption losses while systems are down

- Data recovery and system restoration expenses

- Legal fees and regulatory fines

- Customer notification requirements

- Credit monitoring services for affected customers

- Public relations and crisis management

- Lost customers and damaged reputation

A local accounting firm I know got hit with ransomware during tax season. The $15,000 ransom payment was nothing compared to the $80,000 in lost revenue from three weeks of downtime. They nearly went bankrupt.

What Cyber Insurance for Small Businesses Actually Covers

Cyber insurance policies typically include two main coverage categories: first-party coverage for your direct losses and third-party coverage for claims against you.

First-Party Coverage

This covers your direct costs from a cyber incident:

**Business Interruption**: Lost income while your systems are down. Most policies cover 30-365 days of lost revenue based on your historical financials.

**Data Recovery**: Costs to restore or recreate lost data. This includes hiring forensic specialists and rebuilding corrupted files.

**Cyber Extortion**: Ransom payments and negotiation costs. Yes, most insurers will pay ransoms when it’s the most cost-effective solution.

**Crisis Management**: Public relations help to manage reputation damage. This matters more than most business owners realize.

**Regulatory Response**: Legal costs and fines from privacy law violations. With state privacy laws expanding, this coverage is increasingly valuable.

Third-Party Coverage

This protects you from lawsuits and claims by others:

**Privacy Liability**: Customer lawsuits over compromised personal information. Even small data breaches can trigger class-action lawsuits.

**Network Security Liability**: Claims that your security failure allowed attacks on others. This includes situations where your compromised system becomes part of a botnet.

**Multimedia Liability**: Copyright and trademark violation claims related to your online content.

Additional Services

Most cyber insurance policies include valuable services beyond just money:

– 24/7 breach response hotlines

– Access to forensic investigators

– Legal counsel specializing in cyber incidents

– Data breach coaches to guide you through the process

These services alone can be worth the premium cost. When you’re dealing with a cyber incident at 2 AM on a weekend, having immediate access to experts is invaluable.

How Much Does Cyber Insurance Cost for Small Businesses?

Cyber insurance pricing varies dramatically based on your industry, revenue, data sensitivity, and security practices. Here’s what I typically see:

| Business Type | Annual Revenue | Typical Premium Range | Coverage Limits |

|---|---|---|---|

| Professional Services | $1-5M | $800-$2,500 | $1-5M |

| Healthcare | $1-5M | $1,500-$4,000 | $1-5M |

| Retail/E-commerce | $1-5M | $1,200-$3,500 | $1-5M |

| Manufacturing | $1-5M | $600-$2,000 | $1-5M |

**High-risk industries** like healthcare, finance, and legal services pay premium rates because they’re frequent targets with valuable data.

**Your security posture** dramatically impacts pricing. Companies with strong cybersecurity practices can see discounts of 20-40%. Weak security can make you uninsurable.

Factors That Increase Your Premiums

Insurance carriers evaluate these risk factors:

- Amount of sensitive data you store

- Your cybersecurity training and policies

- Network security controls and monitoring

- Data backup and recovery procedures

- Third-party vendor security practices

- Previous cyber incidents or claims

- Industry and regulatory environment

The good news? Most of these factors are under your control. Improving your security practices reduces both your risk and insurance costs.

Getting the Right Coverage: What to Look For

Not all cyber insurance policies are created equal. I’ve seen businesses get burned by cheap policies with massive coverage gaps.

Essential Coverage Requirements

**Adequate Limits**: Don’t go cheap on coverage limits. A $100,000 policy might seem sufficient, but cyber incidents easily exceed that amount. I recommend minimum limits of $1 million for most small businesses.

**Business Interruption with Waiting Period**: Make sure business interruption coverage has a short waiting period (6-24 hours maximum). Some policies require 48-72 hours of downtime before coverage kicks in.

**Social Engineering Coverage**: This covers losses from email fraud and fake invoice scams. These attacks are exploding in frequency and cost.

**Dependent Business Interruption**: Coverage for losses when a key vendor or supplier suffers a cyber attack that impacts your operations.

Red Flags to Avoid

Watch out for these problematic policy features:

– **War exclusions** that are too broad (some insurers try to exclude state-sponsored attacks)

– **Infrastructure failure exclusions** that eliminate coverage for cloud provider outages

– **Betterment clauses** that reduce payouts if you upgrade systems during recovery

– **Unrealistic security requirements** that you can’t actually maintain

Working with the Right Insurance Partner

Choose an insurance agent or broker who specializes in cyber coverage. General agents often don’t understand the nuances of cyber policies.

Ask potential agents these questions:

– How many cyber insurance policies have you placed in the last year?

– Can you explain the difference between first-party and third-party coverage?

– What security requirements do different carriers have?

– How do you help clients through the claims process?

The Cybersecurity and Infrastructure Security Agency (CISA) provides excellent guidance on cyber insurance considerations for small businesses.

Preparing for the Application Process

**Cyber insurance applications** are detailed questionnaires about your security practices. Insurance carriers use these to evaluate your risk and determine pricing.

Common Application Questions

Be prepared to answer questions about:

- Employee cybersecurity training programs

- Multi-factor authentication usage

- Data backup frequency and testing

- Network monitoring and endpoint protection

- Incident response planning

- Third-party security assessments

- Previous cyber incidents or breaches

**Honesty is critical**. Misrepresenting your security practices can void your policy when you need it most. If you don’t have certain security controls, admit it and ask about requirements for coverage.

Pre-Application Security Improvements

Most carriers require basic security measures before issuing policies. Use this as motivation to strengthen your defenses:

**Multi-Factor Authentication**: Required on all administrative accounts and recommended for all users. This single control prevents most credential-based attacks.

**Regular Data Backups**: Daily backups with offline or immutable copies. Test your restore process quarterly.

**Employee Security Training**: Annual cybersecurity awareness training with phishing simulation testing.

**Endpoint Protection**: Business-grade antivirus/anti-malware on all devices with centralized management.

**Network Monitoring**: Basic network monitoring to detect unusual activity. Many carriers require this for higher coverage limits.

These improvements reduce your risk regardless of insurance coverage. Think of insurance requirements as a **security roadmap** rather than bureaucratic obstacles.

When Disaster Strikes: Filing a Cyber Insurance Claim

I’ve helped clients through dozens of cyber insurance claims. The process goes smoothly when you’re prepared and poorly when you’re not.

Immediate Response Steps

When you discover a potential cyber incident:

- **Don’t panic**—but act quickly

- **Contact your insurance carrier immediately**—most have 24/7 claim reporting hotlines

- **Document everything**—take photos, preserve logs, note timeline of events

- **Don’t make public statements**—let your insurer’s PR team handle communications

- **Use carrier-approved vendors**—your policy may require pre-approved forensic investigators and legal counsel

**Speed matters**. Many policies require notification within 24-72 hours of discovering an incident. Late notification can reduce or eliminate coverage.

Working with Insurance Adjusters

Cyber insurance adjusters are usually more technical than property adjusters, but they’re still insurance company representatives. Their job is to manage claim costs.

Be cooperative but protect your interests:

– Provide requested documentation promptly

– Keep detailed records of all incident-related expenses

– Don’t accept the first settlement offer without review

– Consider hiring a public adjuster for large, complex claims

The Federal Trade Commission’s data breach response guide provides excellent step-by-step guidance for handling cyber incidents.

Conclusion

**Cyber insurance for small businesses** isn’t just another expense—it’s essential protection against threats that can destroy your company overnight. The question isn’t whether you’ll face a cyber incident, but when and how severe it will be.

Don’t wait until after an attack to realize your general business insurance won’t help. Start shopping for cyber coverage today. Get quotes from multiple carriers, work with a knowledgeable agent, and use the application process to improve your security practices.

**Take action now**: Contact three cyber insurance agents this week for quotes. Your future self will thank you when you’re dealing with a cyber incident and have professional support instead of facing bankruptcy.

FAQ

Do I really need cyber insurance if I don’t store credit card information?

Yes. Cyber insurance for small businesses covers more than just payment card breaches. Employee personal information, customer contact lists, business email accounts, and even social media accounts can trigger costly incidents. Ransomware attacks don’t care what type of data you have—they just want to disrupt your operations.

Will cyber insurance cover ransomware payments?

Most policies include cyber extortion coverage that pays ransom demands when it’s the most cost-effective solution. However, insurers won’t pay ransoms to sanctioned entities or in situations where payment is illegal. They’ll also typically require you to use their approved negotiators and forensic experts.

How long does it take to get cyber insurance coverage?

Simple policies can be bound within 24-48 hours if you have strong security practices. Complex businesses or those with security gaps may need 2-4 weeks to complete the underwriting process. Some carriers require security improvements before issuing coverage.

Can I get cyber insurance if I’ve already had a data breach?

Previous incidents don’t automatically disqualify you, but they make coverage more expensive and limit your options. Be completely honest about past incidents during the application process. Some carriers specialize in covering businesses with previous claims history.